We are back this week with a slew of news, something on development status of vaccine to deal with the pandemic, something from Reliance Jio take & something related to Interest Rates, Mortgage Rates & Capital Market Regulators.

We begin with vaccine news as it may take centre stage in the days ahead:

Astrazeneca:

Image Source: https://finance.yahoo.com

- A British Pharmaceutical Giant is set to deliver positive results for early tests of the vaccine as early as in the coming week. It has been developing it with University of Oxford researchers.

- Sarah Gilbert is the face behind the vaccine development at British Pharmaceutical giant. She is well ahead of the world. It’s the most advanced vaccine anywhere in the world as she claims.

- She voiced remarkably confident in her clearance, saying the Oxford Vaccine has an 80% probability of being effective in stopping people who are exposed to the novel corona virus from developing Covid-19.

The Pride of the moment for Indian Pharmaceutical industry:

Image Source: https://tech.economictimes.indiatimes.com

- The Indian pharmaceutical industry which is racing against the time to produce vaccine against Corona Virus has earned backing from one of the most influential voices in the field of philanthropy and businesses.

- Microsoft co-founder Bill Gates has placed his confidence in the Indian pharmaceutical companies to produce COVID-19 vaccines for the whole world, not just for India.

- Gates spoke highly of the capacity of the Indian pharmaceutical industry and said that India is the manufacturing hub of vaccines as more vaccines have been manufactured in India than in the rest of the World. The most of the credit for the same goes to SERUM INSTITUE of Pune.

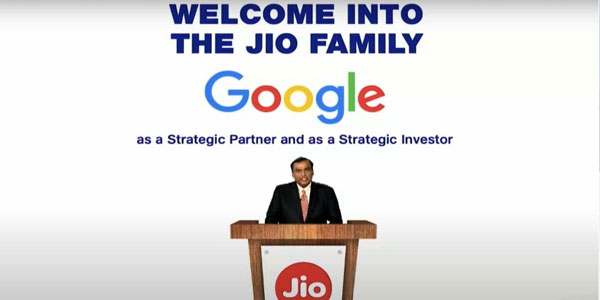

Reliance’s 13th Deal:

Image Source: https://sirfnews.com

- It’s raining incessantly at Reliance for Jio’s deal making. This time around it’s none other than the world giant Google, buying 7.73% equity of Jio investing Rs. 33737 cr.

- Mukeshbhai announced the biggest of the technological advancement in its recently concluded AGM during the last week. The announcement pertains to homegrown development of 5G technology.

- He added that global investors have evinced interest in its Retail venture too and he may announce some deals there too in next couple of months.

- The deal with Saudi Arabia’s ARAMCO stands on a pause mode at this point of time, market gossip says the stalling of the deal largely due to valuation negotiations not going through amid revised scenario for petro products sector.

- What will be more interesting for the years to come, what I foresee is that FB and GOOGLE, two world giants will be playing on the same platform in India, let’s wait for the time to understand how their relations pan out over a period of time on our land.

Something on Interest rate and Mortgage rate front:

- The prevalent interest rate in major markets of the world stands as under:

- U S—— 10 years Bonds rate 0.60%

- Japan— 10 years Bonds rate 0.00% ( 5 yr negative 0.14%)

- Germany-10 years Bonds rate negative 0.45%

- Australia–10 years Bonds rate 0.90%

- India——10 years Bonds rate 5.80 %

- The above rate structure clearly indicates where India is racing ahead in the Yield curve in the coming years. We firmly believe the rates to move southward direction, and probably India’s central bank may cut interest rates by another 50 basis points before we say goodbye to horrific calendar 2020.

- With above as a base case, Mortgage rates in U S has fallen this week below 3% for the first time in a half century. This has led more home owners to seize the opportunity to refinance their home loans and locked the same with a lower interest rate liability tag.

- 9 million home owners have taken advantage of switching over to the lowest ever prevailing Mortgage rates in U S during first four months of the calendar 2020, the deal size being whopping amounting to $ 576.09 billion, ( Rs 43.20 lacs cr in Indian terms )

Something on Capital Market Regulators

Image Source: https://economictimes.indiatimes.com

- Last but not the least for the week from our Capital Market Regulator to remind him of the critics of increased participation by the retailers directly on the equity market platform:

- “The SEBI is perplexed by the record high retail participation in Indian Equities since the lockdown”

- With due respect to the Chair, 80% of U S population, approx 30 cr is directly, indirectly participate in the capital market there, whereas hardly 3-4% of approx 135 cr Indians participate in the capital market here..

- With above most contrasting data, we need to read encouraging statements to see Indian capital market is set to broaden and deepen further to a heightening and lightening speed and not to get PERPLEXED kind of glooms

- One more set of non-matchable turnover data from Nasdaq…their daily turnover runs into Rs 15 lac cr where as our NSE cash segment turnover runs to Rs 55000 cr

- With this, we conclude and will come back with more interesting news for all FLAMINGO readers.